If you drive a lot of miles for your ministry work and you don’t have an accountable reimbursement plan, tracking your mileage can save money on your self-employment taxes. Here are some quick tips for mileage tracking that you may find useful:

- Regardless of whether you use GPS, a phone app or a paper log, pick a system that you feel comfortable with and you will be more likely to use.

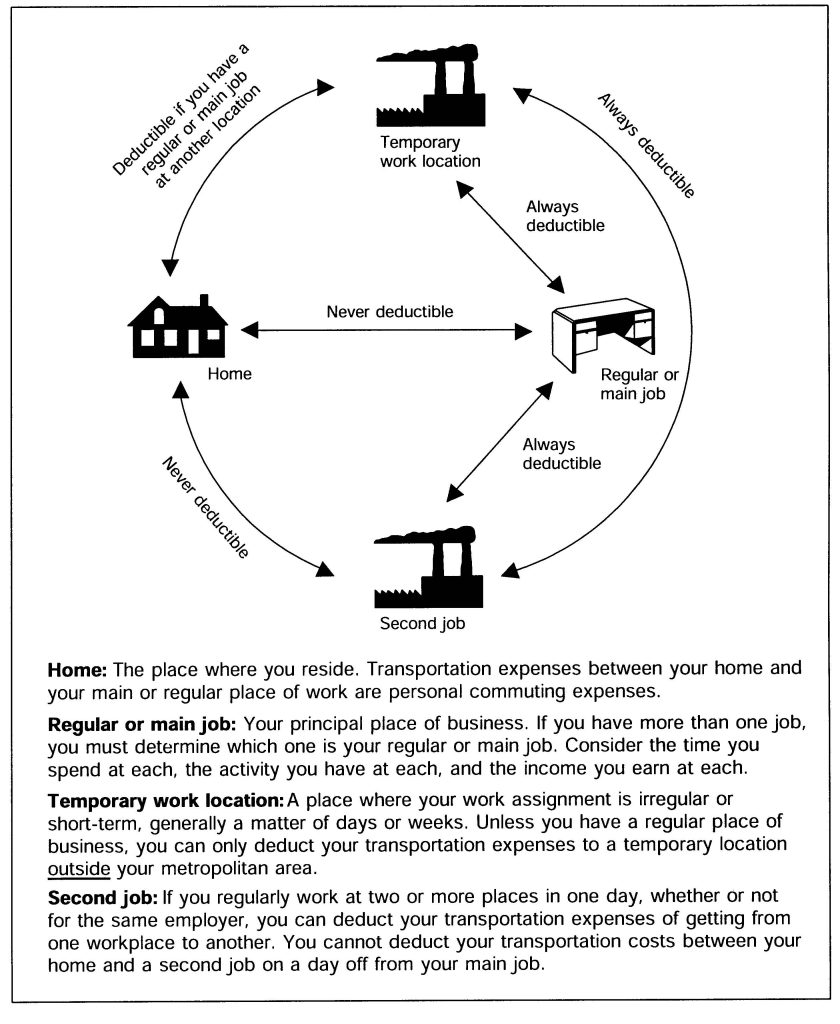

- Your normal commute from home to work and vice versa is NOT deductible. Make sure to record visits to third party locations, since these are deductible.

- Tolls and parking are deductible, so make sure to list these as well.

- If your Church under-reimburses you compared to the government rate, you can claim the difference as a deduction.

- If you have opted out of Social Security for religious reasons, tracking mileage may not actually help you. Those who have opted out of Social Security do not have a Schedule SE on their return, and therefore have nowhere to claim mileage as a deduction

For a free excel mileage log that you can use to track mileage throughout the year, visit our website at https://www.clergyfinancial.com/wp-content/uploads/2015/10/10.Mileage-log.xls

< Back

Clergy Financial Resources serves as a resource for clients to help analyze the complexity of clergy tax law, church payroll & HR issues. Our professionals are committed to helping clients stay informed about tax news, developments and trends in various specialty areas.

This article is intended to provide readers with guidance in tax matters. The article does not constitute, and should not be treated as professional advice regarding the use of any particular tax technique. Every effort has been made to assure the accuracy of the information. Clergy Financial Resources and the author do not assume responsibility for any individual’s reliance upon the information provided in the article. Readers should independently verify all information before applying it to a particular fact situation, and should independently determine the impact of any particular tax planning technique. If you are seeking legal advice, you are encouraged to consult an attorney.

For more information or if you need additional assistance, please use the contact information below.

Clergy Financial Resources

11214 86th Avenue N.

Maple Grove, MN 55369

Tel: (888) 421-0101

Fax: (888) 876-5101

Email: clientservices@clergyfinancial.com