It’s a good idea for people to find out if they should file using the standard deduction or itemize their deductions. Deductions reduce the amount of taxable income when filing a federal income tax return. In other words, they can reduce the amount of tax someone owes.

Individuals should understand they have a choice of either taking a standard deduction or itemizing their deductions. Taxpayers can use the method that gives them the lower tax. Due to tax law changes in the last couple of years, people who itemized in the past might not want to continue to do so, so it’s important for all taxpayers to look into which deduction to take.

Here are some details about the two methods to help people understand which they should use:

Standard deduction

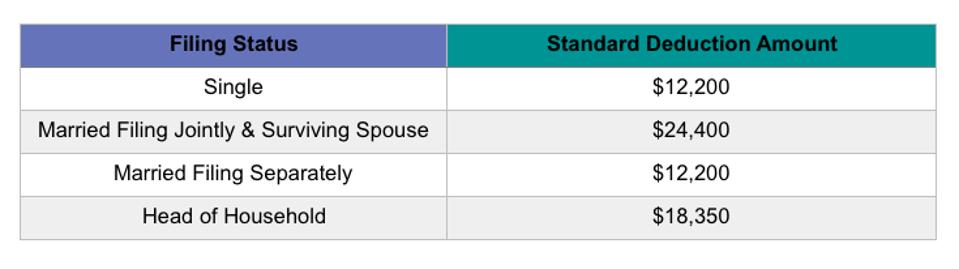

The standard deduction amount adjusts every year and can vary by filing status. The standard deduction amount depends on the taxpayer’s filing status, whether they are 65 or older or blind, and whether another taxpayer can claim them as a dependent. Taxpayers who are age 65 or older on the last day of the year and don’t itemize deductions are entitled to a higher standard deduction.

The standard deduction amounts will increase to $12,200 for individuals, $18,350 for heads of household, and $24,400 for married couples filing jointly and surviving spouses.

Itemized deductions

Taxpayers may need to itemize deductions because they can’t use the standard deduction. They may also itemize deductions when this amount is greater than their standard deduction.

A taxpayer may benefit from itemizing deductions for things that include:

- State and local income or sales taxes

- Real estate and personal property taxes

- Mortgage interest

- Mortgage insurance premiums

- Personal casualty and theft losses from a federally declared disaster

- Donations to a qualified charity

- Unreimbursed medical and dental expenses that exceed 7.5% of adjusted gross income

Have additional questions about whether to claim itemized deductions or the standard deduction? Schedule an appointment with our Pro-Advisors Today.

< Back

Clergy Financial Resources serves as a resource for clients to help analyze the complexity of clergy tax law, church payroll & HR issues. Our professionals are committed to helping clients stay informed about tax news, developments and trends in various specialty areas.

This article is intended to provide readers with guidance in tax matters. The article does not constitute, and should not be treated as professional advice regarding the use of any particular tax technique. Every effort has been made to assure the accuracy of the information. Clergy Financial Resources and the author do not assume responsibility for any individual’s reliance upon the information provided in the article. Readers should independently verify all information before applying it to a particular fact situation, and should independently determine the impact of any particular tax planning technique. If you are seeking legal advice, you are encouraged to consult an attorney.

For more information or if you need additional assistance, please use the contact information below.

Clergy Financial Resources

11214 86th Avenue N.

Maple Grove, MN 55369

Tel: (888) 421-0101

Fax: (888) 876-5101

Email: clientservices@clergyfinancial.com