Commuting expenses deductible?

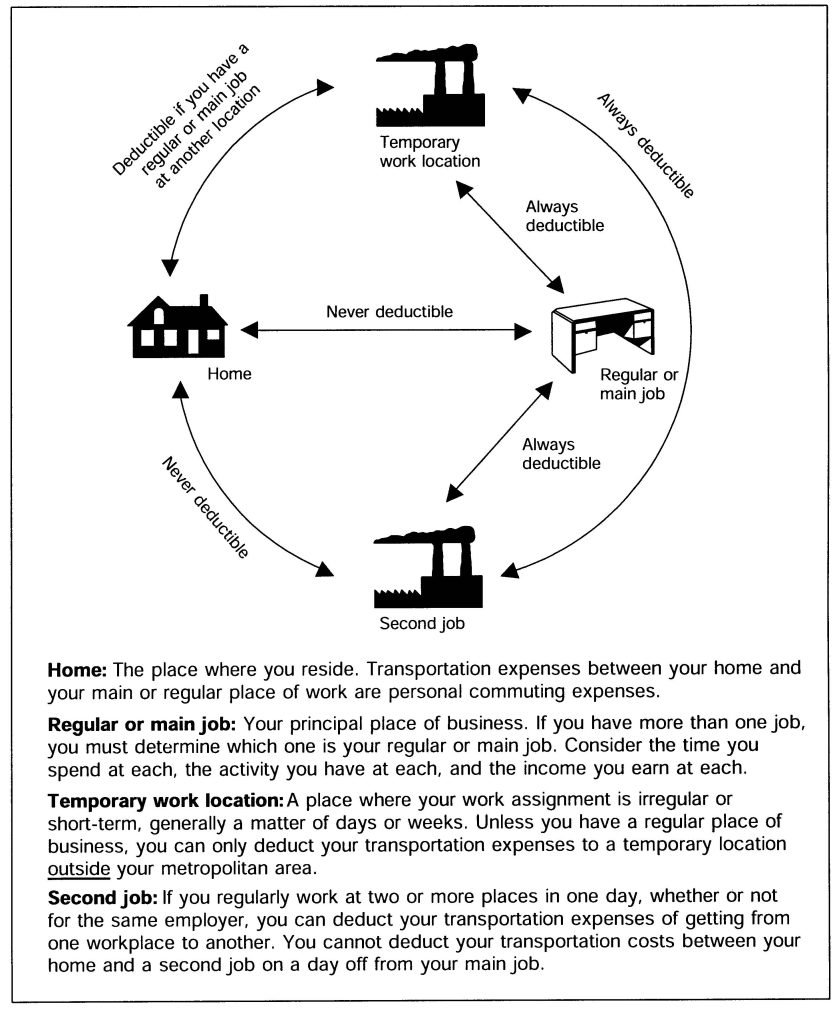

You cannot deduct the costs of taking a bus, trolley, subway, or taxi or driving a car between your home and your main church or regular place of work. These costs are personal commuting expenses. You cannot deduct commuting expenses no matter how far your home is from your church or regular place of work. You cannot deduct commuting expenses even if you work during the commuting trip.

However, if you drive to a hospital, post office, or some other ministry-related stop on the way to or from church, the mileage incurred in driving from the church to the second ministry/business location are deductible expenses even though you are on the way to or from home. The remaining miles between the second ministry/business location and your home are non-deductible commuting mileage. If you are serving two churches, the mileage of driving between these churches are also deductible.

Contact Clergy Financial Resources to help you with the next steps.

Clergy Financial Resources

Tax I Payroll I Bookkeeping I HR

11214 86th Avenue N.

Maple Grove, MN 55369

Tel: 1 (888) 421.0101

Fax: 1 (888) 876.5101

Pro Advisor Support

Schedule an Appointment

Clergy Financial Resources serves as a resource for clients to help analyze the complexity of clergy tax law, church payroll & HR issues. Our professionals are committed to helping clients stay informed about tax news, developments and trends in various specialty areas.

This article is intended to provide readers with guidance in tax matters. The article does not constitute, and should not be treated as professional advice regarding the use of any particular tax technique. Every effort has been made to assure the accuracy of the information. Clergy Financial Resources and the author do not assume responsibility for any individual’s reliance upon the information provided in the article. Readers should independently verify all information before applying it to a particular fact situation, and should independently determine the impact of any particular tax planning technique. If you are seeking legal advice, you are encouraged to consult an attorney.

For more information or if you need additional assistance, please use the contact information below.

Clergy Financial Resources

11214 86th Avenue N.

Maple Grove, MN 55369

Tel: (888) 421-0101

Fax: (888) 876-5101

Email: clientservices@clergyfinancial.com