Can I roll my denomination’s investment plan to an IRA?

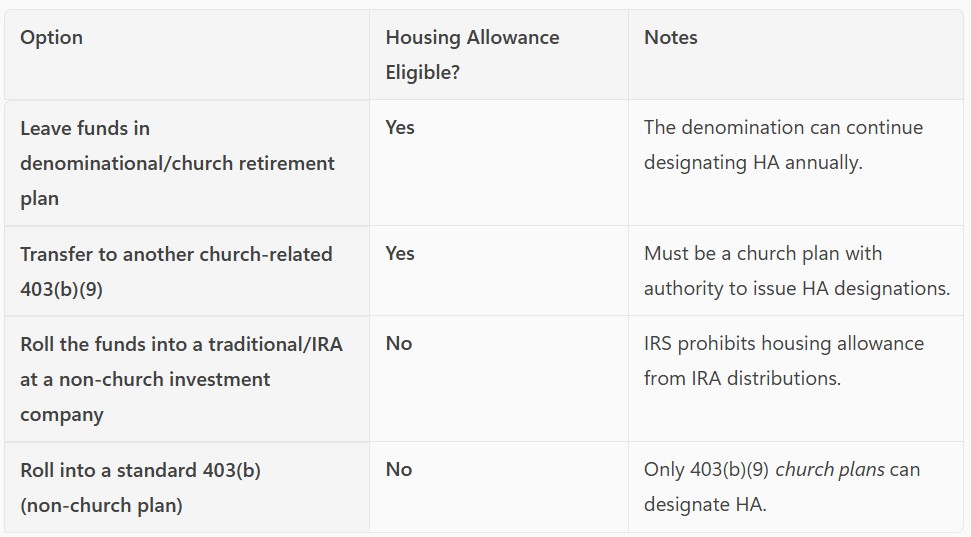

Under IRS rules, you cannot receive a housing allowance designation from an IRA, even if the funds originally came from ministerial compensation. Housing allowance treatment is only permitted when the retirement plan itself is a “church plan,” typically a 403(b)(9), and the designating body is a qualified church or denominational organization.

Your denominational plan is able to designate a clergy housing allowance because the IRS views it as acting on behalf of an employing church for retired ministers. If you leave funds in that plan, those distributions can continue to qualify for a housing allowance.

- The IRS has confirmed that denominational pension boards may designate housing allowance for retired clergy (Rev. Rul. 63‑156).

Once you roll the money into a non‑church IRA, you lose the ability to receive a housing allowance on those distributions. This will permanently eliminate the ability to receive a housing allowance for those funds. No financial institution that is not a church or denominational pension board can designate a housing allowance.

- “You cannot take a housing allowance from an IRA in retirement, even if you used your pastoral compensation to fund it.”

So what are your real options?

If you need guidance that is tailored specifically to your unique situation, we encourage you to connect directly with Pro Advisor Support. Their experienced team specializes in assisting clergy and church organizations with complex tax, payroll, bookkeeping, and HR matters. Whether you have detailed questions about compliance, deductions, or planning strategies, they can provide expert advice and walk you through the next steps with clarity and confidence.

Clergy Financial Resources

Tax I Payroll I Bookkeeping I HR | Consulting

11214 86th Avenue N.

Maple Grove, MN 55369

Tel: (888) 421.0101

< Back

Clergy Financial Resources serves as a resource for clients to help analyze the complexity of clergy tax law, church payroll & HR issues. Our professionals are committed to helping clients stay informed about tax news, developments and trends in various specialty areas.

This article is intended to provide readers with guidance in tax matters. The article does not constitute, and should not be treated as professional advice regarding the use of any particular tax technique. Every effort has been made to assure the accuracy of the information. Clergy Financial Resources and the author do not assume responsibility for any individual’s reliance upon the information provided in the article. Readers should independently verify all information before applying it to a particular fact situation, and should independently determine the impact of any particular tax planning technique. If you are seeking legal advice, you are encouraged to consult an attorney.

For more information or if you need additional assistance, please use the contact information below.

Clergy Financial Resources

11214 86th Avenue N.

Maple Grove, MN 55369

Tel: (888) 421-0101

Fax: (888) 876-5101

Email: clientservices@clergyfinancial.com